Loan Agreements in Azerbaijan: legislative update

On February 24, 2023, important changes were made to the Civil Code in the field of regulation of written contracts, loan and credit relations. These changes will come into force within 6 months after the date of publication, namely from 31st March 2023.

According to the previous text of Article 331.1 of the Civil Code, a written agreement must be concluded by drawing up a document that expresses its content and is signed by the person or persons who concluded the agreement or their duly authorized representatives. However, in relation to this issue, the Constitutional Court noted the legality of the conclusion of the contract by means of electronic communication in the Plenum Decision dated August 12, 2020 on the interpretation of Article 407.2 of the Civil Code. You can get acquainted with the mentioned Decision in detail from this link.

However, according to the amended new content of Article 331.1 of the Civil Code, the contract is considered to be in written form when it is concluded with the help of electronic or other technical means that allow to reflect its content in an unchangeable form on a material carrier. That is, the written agreement can be signed both by the parties and with the help of electronic means of communication.

So, according to the new changes, the provisions related to the loan agreement have been further improved and clearly stated.

According to the previous requirement of the legislation, Article 739.2 of the Civil Code stated that if the subject of the loan agreement is any amount of money, it is called a credit agreement. However, according to the new changes, relations related to the credit are regulated in the form of separate articles.

Another change is that the lender cannot give a loan for the purpose of buying a share (share) in its authorized capital. A share (share) in its authorized capital cannot act as a guarantee for the performance of a loan obligation to the creditor.

Corresponding amendments were also made regarding the cancellation of the obligation to receive and give loan. Thus, if the lender clearly shows that the loan will not be repaid on time due to a significant deterioration of the borrower's property condition or due to the borrower's giving any wrong information to the lender, or if the borrower does not fulfill the obligation provided for in the loan agreement, including if he does not provide security, the loan can unilaterally refuse to fully or partially fulfill the obligation to give. At the same time, the borrower can unilaterally refuse to receive the loan in whole or in part until the subject of the loan agreement is given to him.

As mentioned above, one of the most important changes to the legislation is the already different regulation of loan relations and credit relations and the addition of new provisions to the Civil Code related to credit agreements.

According to the credit agreement, the lender undertakes to give ownership rights to the funds to the borrower in the amount and under the conditions specified in the agreement, and the borrower undertakes to return the received funds to the lender for the period specified in the agreement, subject to the payment of interest and (or) other payments specified in the agreement. Also, the lender under the credit agreement can only be a person who has the right to provide credits in accordance with normative legal acts.

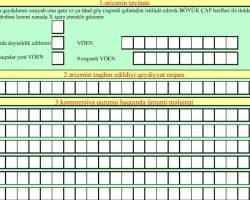

The credit agreement is concluded between the parties in written form and a copy of the credit agreement is given to the borrower. The claim period for the creditor's claims arising from the credit agreement is one year.

One of the important changes made in connection with the credit agreement is the addition of articles related to the concept of consumer credit and its features by regulating the relations related to consumer credit to the Civil Code.

According to the consumer credit agreement, the lender shall lend money to the borrower, who is an individual (hereinafter - the consumer), for purposes not related to entrepreneurial or professional activity, and the consumer shall pay the interest and (or) other payments specified in the agreement on the credit received. undertakes to return in order and time. However, there are some contracts that do not apply to the provisions of the consumer credit agreement. These agreements include credit agreements related to the acquisition of rights to real estate or secured by real estate mortgage, agreements on bank account crediting for up to 90 (ninety) days, credit agreements concluded based on a settlement agreement concluded through court or mediation, etc.

The consumer credit agreement is drawn up in written form on paper or other durable carrier. Also, the consumer credit agreement can be concluded remotely by using one or more means of communication, including the moment when the consumer credit agreement is concluded, without the physical presence of the lender and the consumer at the same time, in accordance with Article 406.3 of this Code. Other requirements for the conclusion of a consumer credit agreement at a distance are determined by the Central Bank of the Republic of Azerbaijan.

Among the added provisions, the consumer's right to refuse the consumer credit agreement is regulated. Thus, the consumer can refuse the consumer credit agreement without giving any reason within 30 (thirty) days from the day of the payment of funds under the consumer credit agreement. In this case, the consumer must pay the money given under the contract and the interest calculated from the day of giving the money until the day it is returned. Except for the amount of state duty and service fees paid by the lender, compensation and any other payments from the consumer are not allowed.

One of the concepts added to the Civil Code as part of the consumer credit agreement is the related credit agreement. A consumer credit agreement concluded for the financing of a contract for the purchase and sale of certain goods or the provision of services and having an economic relationship with that contract is considered a related credit contract. An economic relationship is conditioned by the presence of one of the following circumstances:

a) the lender uses the services of the seller (service provider) in connection with the preparation and conclusion of the credit agreement;

b) the purchase and sale of certain goods (rendering of services) is clearly indicated in the credit agreement.

If you have any questions about loan and credit agreements and their regulation, you can contact us through the following.

[email protected]; +994502898973.

Several significant amendments have been made to the Labor Code of the Republic of Azerbaijan. Th...

Updates on the Registry Information of Legal Entities explained in this article.

The "Rules of control in the field of employment" has been approved by the Cabinet of Ministers o...