IFLR 1000 has ranked Caspian Legal Center and describe as “full-service law and tax consultancy firm” “active across the financial and corporate space and pr...

In this CLC Tax Talk series, we are talking about tax regulations in Azerbaijan. First episode is dedicated to Corporate Income Tax and Permanent Establishme...

The Supreme Court of the Republic of Azerbaijan has articulated its legal position regarding leasing relations, offering a new perspective on the nature of t...

Caspian Legal Center lawyers has contributed the Azerbaijan Chapter to the Chambers Employment 2025 Global Practice Guide with “Law and Practice” and “Trends...

Caspian Legal Center has won "Transfer Pricing Tax Firm of the Year" Award in the CIS region by International Tax Review (ITR 2025 Awards), a prestigious rat...

The Regulation on the “E-accounting” information system has been approved. This step constitutes an important stage of digital transformation in the field of...

Our analysis on the Law of the Republic of Azerbaijan “On Personal Data Protection” has been published by OneTrust DataGuidance, an international platform on...

“Gas Supply Law” of the Republic of Azerbaijan will be replaced by a law of the same name adopted on August 19, 2025. This law will enter into force on Janua...

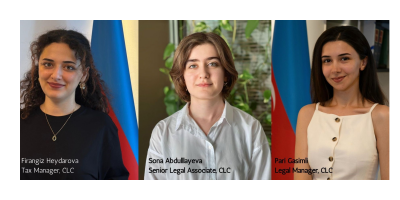

We are pleased to announce that our colleague, Sona Abdulla, has successfully completed her Master of Laws degree at the University of Oxford, United Kingdom...

For the first time in the history of the country, private enforcement agencies (non-state bailiffs) are authorized to participate in the judicial enforcement...

The new law “On Public Procurement” was adopted On July 14 2023. For the purposes of this article...

The Constitutional Court interpreted some articles of the Labor Code

Caspian Legal Center has won "Transfer Pricing Tax Firm of the Year" Award in the CIS region by I...

High-Risk Taxpayer and High-Risk Transactions defined

Caspian Legal Center lawyers has contributed the Azerbaijan Chapter to the Chambers Employment 20...

-400x200.jpg)

_(1)-800x4001-250x200.jpg)